Tips For Ordering Your Tax Free Money – Business Cheques

The advantages of business cheques. Why should you consider business cheques? The advantages of business cheques are many. For starters, they reduce the amount of time a salesperson has to spend selling your company’s goods. If done on a regular basis, also helps your bottom line. Your best resource for business cheques is a wide range of small business cheques available in the market that make it easy for distributors to get pre-qualified products that match your clients cash management and payment needs. With the right choices, your company can benefit from a range of innovative solutions.

Your company is your most significant asset and one that cannot be run without. As such, ensuring the smooth flow of cash is a priority. Whether you’re just starting out or want to streamline your existing manual business cheques, here are some tips on what to look for to get the best out of your accounting software. Check your budget!

Do you need a special format? For you accounting software to function effectively, it must be adaptable to business cheques so that you can deliver a wide range of solutions. Not just limited to manual business cheques, such as invoice processing. Check with your local bank and see if they will help you out or if you have to purchase your own software. Also, don’t forget to consider the cost of printing as the options may vary between banks.

Small business cheque printers for the tax-free environment. If you are going to distribute small business cheques that are considered tax free and have to be hand written, how are you going to do this? You could send the recipients a mailed cheque or, if they would rather not receive a mailed cheque, you could have them file it. While this isn’t ideal, there are some cheque printers available that allow you to print customised labels that allow people to file their chequets electronically.

Think about security features. Some companies might be worried about security features on business cheques, because the risk is that sensitive information might fall into the wrong hands. However, some businesses actually benefit from security features such as encryption. This is important, because when employees handle sensitive information, this encryption prevents other people from being able to access it and use it inappropriately.

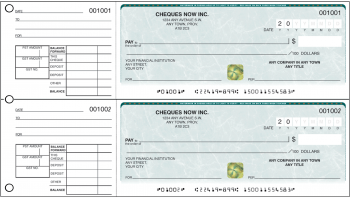

Look for double window envelope printing. Double window envelopes are preferred by many businesses because it allows you to have different messages on each sheet of cheque paper. This means that if there is an urgent need for more funds to pay a bill, a message can be printed on the top and the money can then be funneled through the cheque machine for instant funds transfer. It’s also possible to have a different message on each cheque for personal chequets and business chequets. This is convenient if a client has many chequets to repay, because they will only be sent one envelope at a time, rather than sending all of them at once.

Look at the software. Most businesses will appreciate if they can get a program that not only prints business cheques but allows them to print invoices as well. There are plenty of programs out there that are available at low cost or for free with no strings attached. Consider getting a software program that makes printing invoices and business cheques simple so that a businessperson doesn’t have to be concerned about remembering complicated security features.

Finally, get a free program for customizing business cheques that lets you enter your own information. Most people enter their social security number, income information, and the business logo. A tax symbol is optional and can be useful when you want to show your clients how much tax free food, clothing, or household items you provide. You can also put in information about special discounts such as student discount, senior discount, or a membership discount. Be careful, though, that you don’t put in too much information so that it looks like the cheque will never be cashed out, which could lead to legal problems. Just remember that a tax symbol can help you, so make sure you put the appropriate tax symbol on your cheque for easy tracking and identification.

The Growing Popularity of Business Cheques or cash. Why Cheque Prints for Business Cheques?

To avoid security threats and frauds when paying by credit card. Most businesses today keep personal cheques in their office safe while keeping business cheques at their own bank safe. While both personal and business cheques can be accessed quickly by anyone. Security features like authorization codes and PIN numbers are being added to ensure protection from theft. Besides that, some companies provide their employees with smart cards that can only be accessed from specific locations. Thus, there are many businesses that keep personal cheques and business cheques under lock and key.

Today, almost every organization is using accounting software, especially accounting software designed for businesses. However, accounting software alone will not suffice without business cheques printing. As you may not know, manual business cheques have the advantage. Of being more time-consuming and more tedious to prepare and manage. But it is time consuming only if you are unable to understand the manual. Or if you are unable to comply with the regulations regarding time-keeping.

If you use accounting software but if you are unable to understand the manual. Then you may opt for a printed copy of business cheques. The advantage of using a print copy is that you will be able to easily determine the correct amount due. And you will be able to file it electronically.

In addition to that, with online banking or Internet-based banking. It would be very easy to determine the payees or beneficiaries of a particular check. This is helpful in case you need to know the name of the payee. Or the beneficiary of a particular cheque. But you do not know how to access it through the Internet or if the person is out of town. Personal chequebooks can also help avoid mishaps during the time when you are in the office. Then you can simply take a printed copy of your to the bank and pay the amount immediately.

There are certain companies or agents offering business cheque printing services. That allow you to print cheques on business card holders and custom ID cards. Their include cheque images of business cards and custom ID cards. Hence, if you want to send an official document to an authorized recipient. Such as a receipt or a letter of credit to a client. Then you can rely on that come with attractive documents. This will make the process of handing over official documents to your clients much simpler.

If you are looking for convenient alternatives to traditional personal cheques, then computer cheques can help. These cheques do not require printing fees and are available with different design options. You can also add the image of a business card to personal cheques. However, there are some drawbacks of using computer cheques.