What is a pip in Forex

We hear the term “forex” in the news and in the global market, and this might confuse and overwhelm someone. It is especially troublesome for new traders, and hearing terms like PIP in Forex also creates confusion for traders and beginners.

The solution is this article as we will discuss PIPs in forex, Forex, trading, five trading strategies, effects, Working of PIP, Profitability in PIP, Real Life Example of PIP, Steps to calculate PIP, What is PIP value and how pip calculator works. After reading this article, you will know about these topics and know how vital pip is in Forex, how Forex is essential in the world and how traders can do trading effectively. You can earn money by using these strategies. So let’s dive into it and talk about every topic one by one:-

What is Forex Trading?

Foreign exchange is buying and selling of currency in the market. Forex trading is also used for international trades to improve international relations and the economy of the country. The Forex market is a market with the most liquidity. Currencies trade on an exchange rate basis. The exchange rate is generally decided by the demand supply in the market and managed by the country’s central banks. The forex market has both a cash market and derivatives market, and it offers futures, options, currency swaps, etc.

Market participants use forex markets to hedge against currency and interest rates. They also guess upcoming political events, expand their portfolio and much more.

What is PIP?

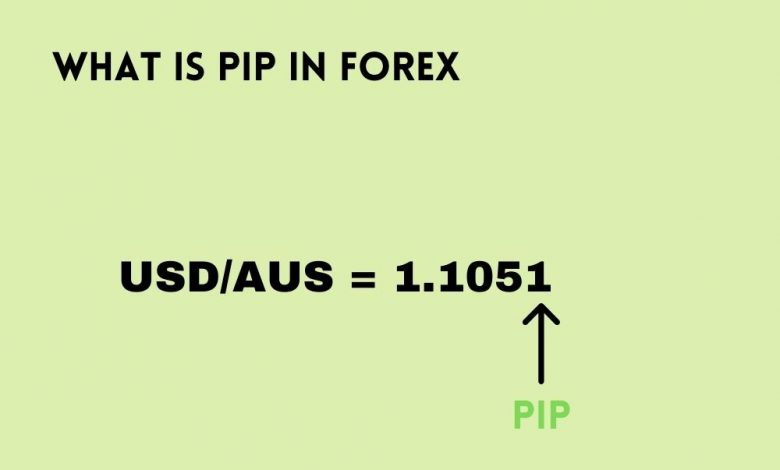

Percentage in point or PIP is the change in the exchange rates, and the change is in currency pair or quote terms. A basis point is 1/100 of 1% or 0.001, and a standard measure prevents huge losses for an investor. One point change makes the market highly volatile, and it is the small unit of price change in the forex market. The currency pairs value is in four decimal points. The fourth decimal point is PIP change.

If we have a direct quote of USD/EURO as 0.8531 means, you can buy 0.8531 euros for 1$. But if PIP changes to 0.8535 mean, you can buy more euros per dollar.

Forex trading is highly leveraged, and only a single point difference affects profits and losses significantly.

How PIP Works:-

One of the basic concepts in forex trading is PIP, and it is used to communicate the exchange rate by ask quotes and bids. The exchange rate is accurate to four decimal points. Forex trading is buying and selling a currency, and the value of that currency is stated in relation to other currencies.PIP measures the movement in the exchange rates. The minor change in PIP is 1 PIP because the currency is quoted in 4 decimals. Example:- If a trader is buying Euros, then they are selling US dollars, and if they are buying US dollars, then they are selling Euros.

PIP is also referred to as the spread between the ask and selling price of a currency. Mostly the currency pairs are in four decimal places, but currency pairs of Japanese Yen are in two decimal places.

Effects Of PIP:-

Suppose a trader purchases 100 euros from the US dollar. Then you have to pay $117.21 [1/0.8531]*100. If there is an increase of one PIP, you have to pay `$117.20[1/0.8532] *100.

PIP value on a lot of 100 euros is 0,.01 ( 117.21-117-20)

PIP is the primary currency to measure during currency trading.

If you purchase 10000 euros, then the PIP value will be US$1.37

This example explains that the PIP value increases according to the corresponding currency bought.

A real-life example of PIP

Devaluation and hyperinflation can move the exchange rate to an uncontrollable point. Devaluation and hyperinflation affect traders with a lot of cash, making trading uncontrollable and losing PIP’s meaning. For example:- the Turkish lira reached 1.6 million per dollar in 2001. So the government removed six zeros, and they named it the new Turkish lira. The current exchange rate of the Turkish lira is 8.47 per dollar.

Profit from PIP

The movement in currency exchange rates tells the profit and loss made at the end of a single trading day. The trader will benefit if they buy USD/JPY (US dollar/Japanese yen)

and the price of the Japanese Yen increases as compared to US dollars. If a trader purchases USD at 110.03 and exits at 111.01. The trader will lose 98 PIPs on this trade. If a trader buys GBP/USD at 1.37 and exits at 2.02, the trader will earn 65 PIP. Even though PIP might be a meagre amount to you, if there’s a trade of millions or billions, then profit or loss of currency can be significant.

Forex PIP scalping Strategy

There are two PIP scalping strategies you can use. Let’s discuss them one by one:-

50 PIPs a Day

50 PIP in a day is a realistic target because the average daily range in major pairs is a minimum of 50 PIPs. When you trade with a 50 PIPs scalping strategy, you have an excellent reward to risk ratio and a safe stop loss. Traders want a setup with at least a 2:1 reward to risk ratio. IF you have 50 PIP, then 25 PIP will be an ideal risk while trading. 25 PIPs is a safe stop in major currency pairs.

If you aim for 20 PIPs a day as a target, the stop loss will be too risky, or the risk-reward ratio will not be good. When you enter forex trading, ensure a safe stop loss of at least 20 PIPs, and the reward and risk ratio is maintained. That’s why 50 PIPs a day is preferred over 20 PIPs a day because there is a safe stop loss, and the reward risk ratio is maintained.

100 PIPs a Day

Two methods can achieve 100 PIPs a day. The first way is to execute two trades in a day of 50 PIPs and take profits. It is a practical method. If you want to achieve 100 PIP a day with only one trade per day, then you should focus on GBP pairs. GBP pairs in base or quote currency can travel 100 PIPs a day easily. The Average Daily Range(ADR) of GBP pairs is at least 100 PIPs a day. Therefore, if you want 100 PIPs a day from a single trade, you should trade in GBP pairs.

GBP pairs are aggressive, so you have to be careful while trading. The movement in GBP pairs is fast, so there is a high risk and high reward situation. To earn 100 PIP’s a day and 50 PIPs a day, you need a precise strategy.

How to calculate PIP value?

First, we multiply the total trade of the lot in one pip(in decimal point) and then divide it by the exchange rate of the underlying currency in the currency pair. Traders earn minimum 50 PIPs in the major pair, that’s why it is a realistic target.

What is PIP Value?

In Forex? PIP value is the change in trade position caused by a change in PIP move, and other factors stay equal. The local or base currency should display PIP value in the local or the base currency. The base currency you specify changes the numeric value of position during account opening. Suppose you have an account that trades in a specific currency. In that case, the PIP value of a particular currency pair that is not included in the account currency will have an extra exchange rate charged. The reason behind this is that you have to convert that currency to your account currency to compare pip value to other trading positions in your account.

For example, the PIP value for GBP/EUR trade will be higher than the US dollar because GBP has a higher value than the US dollar. Therefore, while holding a position, There is a more capital intensive effect on the margin required when dealing with EUR/GBP.

Steps to calculate PIP value

Step 1:-PIP value Discovery

Find out the PIP Value. It is generally 0.001, but currency pairs with low values like the Japanese Yen have 0.01 or two decimal values.

Step 2:Figure out the exchange rate of a particular currency pair.

Step 3:Use the below formula to calculate the PIP value of the position.

PIP value= (PIP size/ Exchange rate) * Position Size

Step 4:- Change PIP value in account currency according to the general exchange rate.

Examples of PIP calculation:-

All the currency pairs have the same PIP value with US dollar trade as the counter currency. US dollar is the counter currency for all the major currency pairs like GBP/USD, NZD/USD and others.

So the currency pair movement will represent one pip increase in the exchange rate. So PIP will be 0.001. This one pip movement will be equal to $0.01 for 1000 of the base currency, $1 for 10000 in base currency and 10$ for 100,000 of the base currency. It will be a US denominated account for PIP values.

When pip size is 0.001 and you have to measure PIP value for EUR/USD, then spot rate is 1.1722 and position size is 100,000

( 0.0001/1.1722)*100,000= 8.530

PIP value is 8.530 Euro. To calculate the amount in US dollar of PIP value, Multiply PIP value with current exchange rate

8.530* 1.722 = $14.68

PIP value gives you an idea about the risk involved and the margin you need per PIP when you enter a position of a currency pair with the same volatility. You can’t assess the risk of holding a position of a currency pair without calculating the PIP value of a currency pair.

PIP value of currency pair is multiplied with leverage as forex transactions are highly leveraged. When you know the PIP value, you can use money management to enter the ideal position size within your limit and the risk you can bear. On the other hand, you can end up taking too much risk without knowledge.

Conclusion

PIP in Forex is a point in percentage that measures the amount of change in currency. Forex trading pips help to understand the change in exchange rates. You can understand how PIP works, and Profits in PIP are made using the PIP calculator. The Forex PIP calculator helps you understand the exchange rate difference and how PIP value change can cause a huge difference in profit and loss. You can know the PIP value after using the PIP value calculator or calculating PIP through the PIP calculator. Know you in forex trading, what is PIP or PIP meaning in Forex, The terms around it and the calculation process